Department Of Defense Mla Status

defense status wallpaperExplore trending topics experience DOD through interactive pieces engage by testing your wit with quizzes and observe DOD in action via photos and videos. This bill is in the first stage of the legislative process.

Answers To The Top Mla Questions Posed By Lenders Experian Insights

Nov 19 2019 116 th Congress 20192021 Status.

Department of defense mla status. Nov 19 2019 Length. In a new interpretive rule published on February 28 2020 the Department of Defense DoD has announced that it is withdrawing guidance previously issued in its December 14 2017 Interpretive. Head to the redesigned Defensegov where you can learn all about the Defense Department.

The MLA better protects our service men and women from predatory credit. It was introduced into Congress on November 19 2019. This interpretive rule takes effect immediately and it both.

However financing for credit related costs would not be excepted. Introduced on Nov 19 2019. Information you provide is used to verify an individuals record of enrollment in Defense Enrollment Eligibility Reporting System DEERS for the purpose of furnishing certification or information of active duty status left active duty within 367 days or of a notification to report to active duty for a given active duty status date.

Last July the Department of Defense DOD published a Final Rule to amend its regulation implementing the Military Lending Act significantly expanding the scope of the existing protections. After nearly three years of study the Department of Defense today issued the final Military Lending Act MLA rule. Would it be ok for us to have the customer sign our old form the Covered Borrower Identification Statement saying they are.

Financial institutions must create accounts with the site in order to determine the active duty status of a borrower to determine if provisions of the MLA apply. This web site enables creditors to determine whether a consumer is a covered borrower for purposes of the MLA and avail itself of an optional safe harbor from liability. To obtain an individuals active duty.

In 2006 Congress passed the Military Lending Act MLA to help protect active duty service members and their dependents from predatory lending. As previously mentioned the MLA v 57 release will include enhanced security features and measures. However knowing its a federal violation to pull these after the loan has been originated and some are not getting pulled before origination.

On February 28 2020 the Department of Defense amended its interpretive rule opens new window for the Military Lending Act MLA regulation. The change withdraws a specific QA of the revised interpretive rule issued in 2017 and reverts back to the QA from the original interpretive rule issued in 2016. Time to brush off those compliance plans and ensure you are prepared for the new regulations specifically surrounding the Military Lending Act MLA.

The interpretive rule amends four of the QA format interpretations that DoD issued on August 26 2016. Read Text Last Updated. Last week the Department of Defense DoD issued an interpretive rule under the DoDs Military Lending Act final rule MLA Rule.

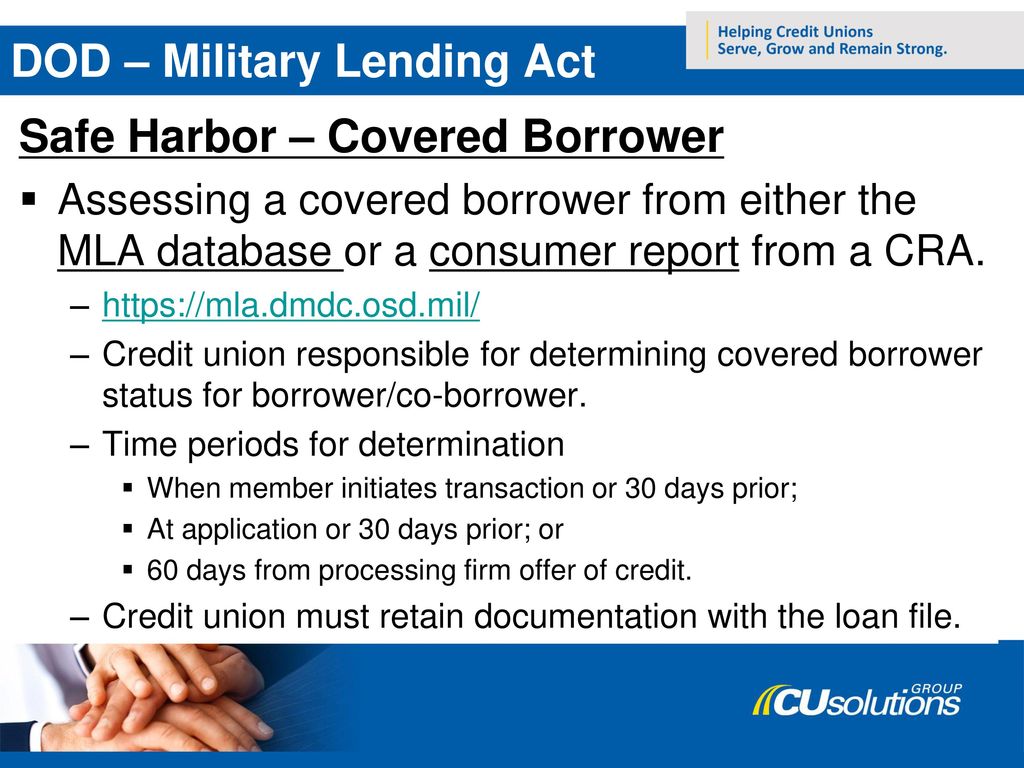

Section 2325 explains the methods available to creditors when determining a consumers covered borrower status prior to or at the time the parties enter into a transaction or an account is createdThe provision permits a creditor to use its own method to assess covered borrower status and it provides a safe harbor to a creditor that employs either of two available methods. The Department of Defense has finalized changes to its Military Lending Act MLA website which is used to check a servicemembers active duty status. The Department of Defense DoD published a new interpretive rule rule under the Military Lending Act MLA on December 14.

The MLA provides important safeguards to members on Active Duty and their dependents in consumer credit transactions. Readers may recall that the DoD published this guidance just over one month before the MLA. The Department of Defense has finalized changes to its Military Lending Act MLA website which is used to check a servicemembers active duty status.

The Department of Defense in its 2017 guidance stated that the answer depends on what the credit beyond the purchase price of the motor vehicle or personal property is used to finance Under this guidance financing costs related to the object securing the credit will fall within an MLA exception. In 2015 the Department of Defense DOD issued a final rule amending the MLA to cover a wider range of credit products impacting traditional creditors like banks and credit unions. Financial institutions must create accounts with the site in order to determine the active duty status of a borrower to determine if provisions of the MLA apply.

The mission of the Department of Defense is to provide a lethal Joint Force to defend the security of our country and sustain. The NCLC site states that the MLA was sharply restricted by Department of Defense regulations limiting MLA coverage of consumer credit to certain payday auto title pawn and refund anticipation loans There were new rules in 2015 that expanded protections to include nearly any form of credit. MLAs planned systems upgrade originally scheduled for January 19 2021 is now scheduled for Thursday January 14 2021.

Currently we pull the Certification of Military Status from the Department of Defense website and keep them in the loan file. In a new interpretive rule published on February 28 2020 the Department of Defense DoD has announced that it is withdrawing guidance previously issued in its December 14 2017 Interpretive Rule QA 2 governing motor vehicle and other personal property financing and will revert back to the position it set forth in the original QA 2 published in the August 26 2016 Interpretive Rule. It will typically be.

Representative for New Yorks 6th congressional district.

Https Www Cuna Org Uploadedfiles Compliance Mla Guidance Summary Pdf

Choosing Your Mla Solution Direct Or Indirect Experian Insights

Https Mla Dmdc Osd Mil Mla Services Content Documents Userguide

Military Lending Act Mla National Credit Union Administration

Discussion Paper Statistics Norway Research Department Of Defense Research Paper Introduction Research Paper Title Page Term Paper

Https Consumer Sc Gov Sites Default Files Documents Business 20resources 20laws Regulatory Pawnbrokers Mla 20for 20pawnbrokers Pdf

Hyderabad Income Tax Sleuths Swooped On A Hyderabad Based Infrastructure Company Reportedly Owned By Trs Kukatpally Mla M Krishna Rao S Son M Mla Company Trs

Dod Cites Nafcu Dcuc As It Makes Key Change For Mla Relief Nafcu

Everything You Need To Know About Amex S Generous Military Benefits Forbes Advisor

Military Lending Act Implementation Determining Covered Borrower Status Cuinsight

Military Lending Act Mla Ppt Download

Gap Insurance And The Military Lending Act The Challenge Remains Automotive Buy Sell Report

Mla Citation Style Overview Writing Explained

Department Of Homeland Security And U S Coast Guard Announce Extended Maternity Leave Policy Homeland Security Homeland Security Maternity Leave Coast Guard

The Military Lending Act Mla Went Into Effective In 2006 It S Designed To Protect Active Duty Military Members Finance Retirement Finances Personal Finance