Military Spouses Residency Relief Act Missouri

military residency wallpaperA nonmilitary spouse of a service member who qualifies under Military Spouse Residency Relief Act MSRRA can choose to keep that same legal residence as the military spouse. 11 2009 - S.

The Greater Kansas City Chapter Of The Apa Meeting Event Information

The Military Spouses Residency Relief Act effective for the 2009 tax year and forward prevents income earned by servicemembers spouses from being taxed by any state other than the state they declare as their state of residence.

Military spouses residency relief act missouri. It allows military spouses to maintain legal residence in the state where they lived before a permanent change of station move with their active-duty service member. Expansion of authority for noncompetitive appointments of military spouses by Federal agencies. For information on guidance for each state when dealing with MSRRA see the second column of links below.

Shown HerePublic Law No. However the Military Spouse Residency Relief Act doesnt automatically extend this exemption to a spouse. The Military Spouse Residency Relief Act gives you the ability to choose whether to claim the state you are living in or your spouses legal residence for tax purposes.

Spouse must not be a resident of Missouri. The Military Spouse Residency Relief Act MSRRA refers to section 302 of the Veterans Benefits and Transition Act of 2018 and allows for spouses to elect to use the same legal residence as the service member during any taxable year of the marriage. 475 Be it enacted by the Senate and House of Representatives of the United States of America in Congress.

This way multiple states and tax localities wont tax you when your spouse moves for military service. Spouse in state solely to be with service member. Military Spouses Residency Relief Act.

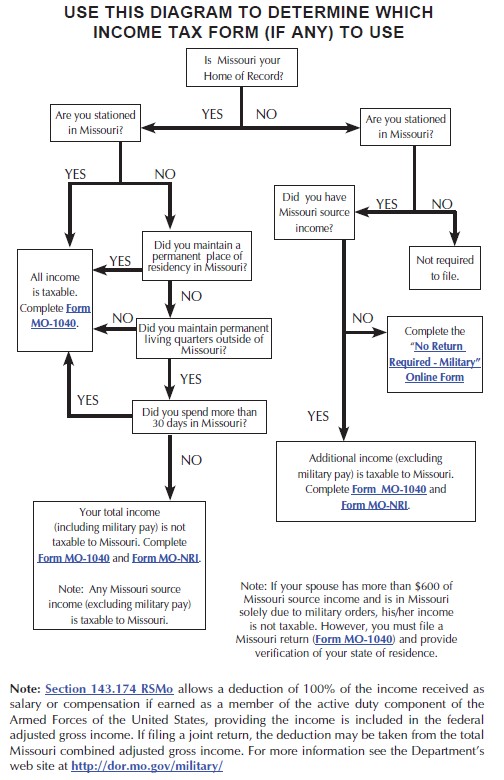

According to the Missouri Department of Revenue The Military Spouses Residency Relief Act effective for the 2009 tax year and forward prevents income earned by service members spouses from being taxed by any state other than the state they declare as their state of residence. In 2009 the Servicemembers Civil Relief Act was amended by the Military Spouse Residency Relief Act. There was a change to the MSRRA the Veterans Benefits and Transition Act of 2018 which became Public law on December 31 2018.

The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the Service member SM in compliance with military orders when that State is not the spouses domicile legal residence. If you are the spouse of a military service member are in Missouri because the military service member is stationed in Missouri on military orders and your state of residence is another state any income earned. The Military Spouses Residency Relief Act MSRRA as it was first passed in 2009 allowed military spouses to claim for tax purposes the same state of domicile as their service member as long as.

The Military Spouse Residency Relief Act MSRRA provides protection to military spouses related to residency voting and taxes. Military Spouses Residency Relief Act MSRRA Public Law 11197 1. This Act may be cited as the Military Spouse Employment Act of 2018.

The Military Spouses Residency Relief Act MSRRA lets you keep the same state of legal residence as your service member spouse. You must simply be able to prove that you have lived there too. Updates to the MSRRA clarify confusion between domicile and resident statuses for military spouses.

A Expansion To include all spouses of members of the Armed Forces on active dutySection 3330d of title 5 United States Code is amended. Their home of record state. This means that in order for the spouse to be able to vote he or she will be required to re-enter the domiciled state or send in an absentee ballot.

The Servicemembers Civil Relief Act prevents military personnel from being taxed on military income by any state other than their home of record of state. The MSRRA amends the Servicemember Civil Relief Act SCRA to include the same privileges to a military servicemembers spouse. Military Spouse Residency Relief Act.

Government Printing Office Page 123 STAT. This allows military spouses to claim for tax purposes the same state of residence as their service member spouse for income tax. The Military Spouses Residency Relief Act also allows spouses who relocate to their serviceman spouses stationed residency to maintain voter rights in the domiciled state of the spouse.

The Military Spouses Residency Relief Act effective starting in tax year 2009 prevents income earned by servicemembers spouses from being taxed by any state other than the state they declare as their state of residence. Missouri No Return Required - Military is available online at httpssadormogovnri. Also a state might exempt military income earned while the service member is out-of-state on military orders.

To determine if any income for a military individual and spouse if. The MSRRA can be a complicated law and its been interpreted differently by the states. A second amendment to the SCRA provides additional protections and benefits.

Military Spouses Residency Relief Act doesnt say much except to check back later but this is the right page Business Wire article. 3007 Public Law 111-97 111th Congress An Act To amend the Servicemembers Civil Relief Act to guarantee the equity of spouses of military personnel with regard to matters of residency and for other purposes. 111-97 11112009 111th Congress Public Law 97 From the US.

Service member in state in compliance with military orders.

Military Spouse Act Residency Relief Msrra Military Benefits

Whiteman Air Force Base Community Tax Toolkit Missouri Taxes

Missouri State Tax Information Support

Http Www Stlouis Va Gov Neo Mo W 4 Pdf

Https Www Showmeboone Com Assessor Common Pdf Personalpropertymissourilaw Pdf

Https Dor Mo Gov Forms Mo 1040 Instructions 2009 Pdf

Pin On Military Spouses Connect

Https Dor Mo Gov Forms 4282 2020 Pdf

Https Dor Mo Gov Forms 558 Pdf

Missouri The Official Army Benefits Website

Https Dor Mo Gov Forms 4711 2018 Pdf

Https Dor Mo Gov Forms Mo 1040 Instructions 2014 Pdf

Attention Iwx Drivers Residing In Iwx Motor Freight Facebook

State Tax Filing Info For Working Military Spouses The Official Blog Of Taxslayer

Demystifying The Msrra Military Spouse Residency Relief Act By Nicci Clark