How To File Military Spouses Residency Relief Act

file military reliefMilitary Spouses Residency Relief Act Signed. File Form AR1000NR and write Military Spouse on top of the front page of the return.

Demystifying The Msrra Military Spouse Residency Relief Act By Nicci Clark

This Act effective 2009 specifies that a spouse of a service member may be able to exclude wages from personal income tax if the spouse is not a resident of the jurisdiction where the income is earned.

How to file military spouses residency relief act. On the W2 screen in the Special tax treatment option drop list select code R. It was further updated in 2018 to include specific protections for all military spouses. Click Save until Exit California Return.

Military spouses face a lot of challenges and filing your taxes may be one of them. This box has been moved to the CarryoversState Info tab starting in Drake19. This way multiple states and tax localities wont tax you when your spouse moves for military service.

Service member may be exempt from Maryland income tax under the Military Spouses Residency Relief Act when the spouse of the service member is not a legal resident of Maryland. Complete the CA Resident Status indicating you were a nonresident of the state. Scroll down to If you are military and enter the state you were stationed in.

The Military Spouses Residency Relief Act Public Law 111-97 S. The Military Spouses Relief Act was signed into law on November 11 2009 effective for tax years beginning on or after January 1 2009. A copy of the nonmilitary spouses drivers license from the resident state.

According to the Missouri Department of Revenue The Military Spouses Residency Relief Act effective for the 2009 tax year and forward prevents income earned by service members spouses from being taxed by any state other than the state they declare as their state of residenceIf you are the spouse of a military service member are in Missouri because the military service member is. In Drake15 and prior on the C screen code R is located on the Special tax treatment code option drop list. It allows military spouses to maintain legal residence in the state where they lived before a permanent change of station move with their active-duty service member.

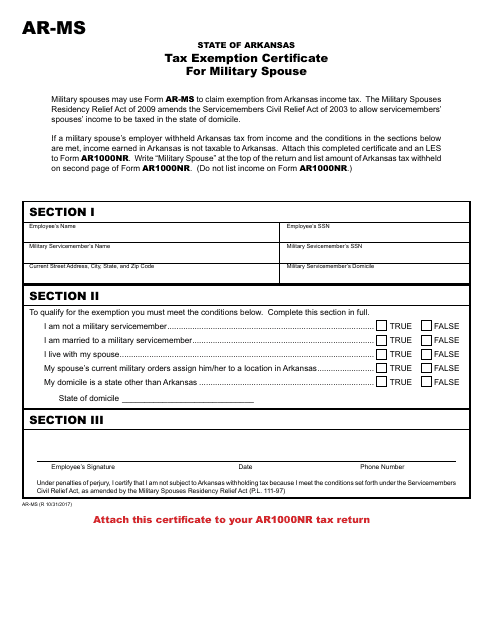

If requirements are met for the relief the military spouse should file Form AR-MS to exempt income from Arkansas withholding. Voting A military spouse may vote within their spouses legal state of residence. A copy of the nonmilitary spouses military ID card identifying the card-holder as the spouse.

The Military Spouses Residency Relief Act MSRRA is important law but it is very misunderstood. Attach Certificate AR-MS and any additional documentation LES or other pertinent information to help in the processing of your return. According to the Maryland website The wages earned by a spouse of a nonresident US.

My servicemember spouse is from a state I never lived in. 475 is designed to provide relief from certain tax restrictions placed on the spouses of military servicemembers. Prior to this Act being signed into law a military servicemember was permitted to use their home state as their legal state of residence regardless of where they were stationed.

This means that in order for the spouse to be able to vote he or she will be required to re enter the domiciled state or send in an absentee ballot. This allows for refunds of any taxes withheld on the exempt income. Yes provided you are present in Virginia solely to be with your service member spouse who is permanently stationed here in compliance with military orders and the income you received in Virginia is from wages or salaries earned as an employee or is derived from certain limited self-employment.

It may affect the state income tax filing requirements for a spouse of an individual in the military. The military spouses residency relief act allows military spouses to declare the same state of legal residency as their spouse. A second amendment to the SCRA provides additional protections and benefits.

The Military Spouses Residency Relief Act MSRRA lets you keep the same state of legal residence as your service member spouse. The Military Spouses Residency Relief Act amends the Servicemember Civil Relief Act to include the same privileges to a military servicemembers spouse. I have the same state of residency as my servicemember spouse.

On the C screen check the box Military Spouses Residence Relief Act. Military Spouses Residency Relief Act MSRRA Public Law 11197 1. A copy of the nonmilitary spouses W-2 issued by the employer.

Military spouses no longer have to file multiple part-year and nonresident income tax returns when they earn wages. Federal Military Spouses Residency Relief Act. The military spouse residency relief act msrra refers to section 302 of the veterans benefits and transition act of 2018 and allows for spouses to elect to use the same legal residence as the service member during any.

This Act allows a servicemembers spouse to keep a tax domicile legal residence throughout the marriage even if the spouse moves into California so long as the spouse moves into. However if youre the spouse of a military service member you fall under special rules. Can I keep that state for residency or do I have to change it with every PCS.

In 2009 the Servicemembers Civil Relief Act was amended by the Military Spouse Residency Relief Act. Passed in 2009 it is actually an amendment to the Servicemembers Civil Relief Act SCRA to provide certain specific protections to some military spouses. Am I exempt from filing Virginia income tax returns under the Military Spouses Residency Relief Act.

The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the. If this is the first time youve filed taxes for your military household there are some important things to know. Scroll down to If you were a nonresident of California for the entire year and enter your state of residence.

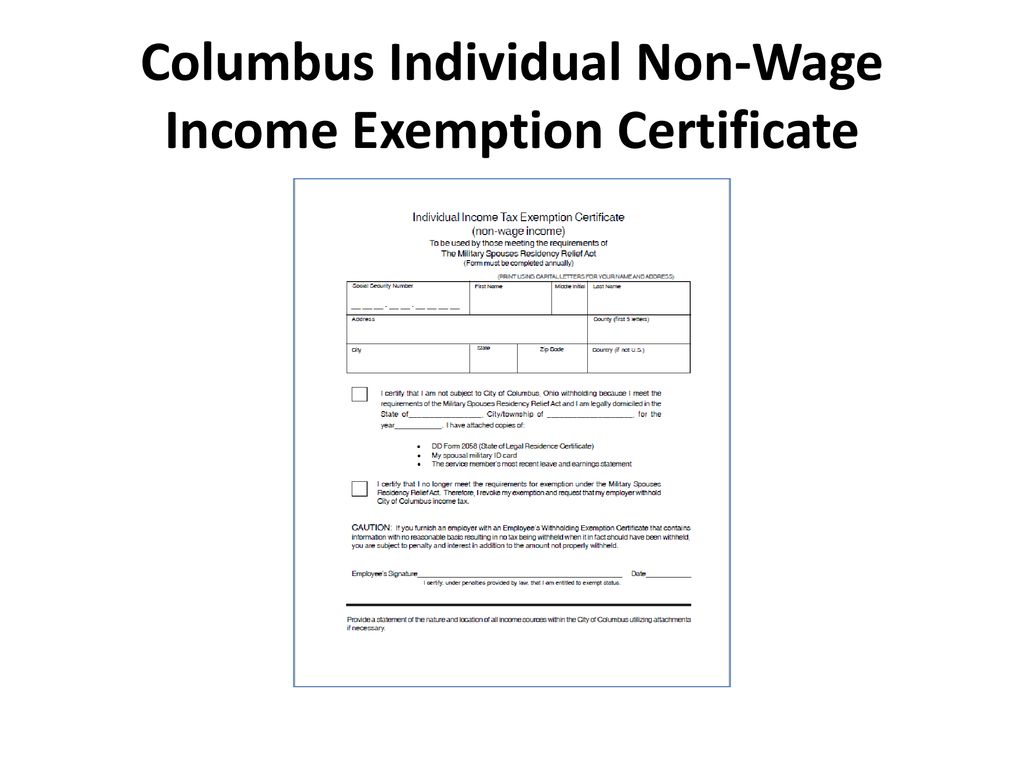

A copy of the nonmilitary spouses tax return filed with the resident state. Its normal to feel overwhelmed if you dont understand how tax laws apply to you. Form DD 2058 State of Legal Residence Certificate may need to be filled out according to state requirements.

You can choose to keep your state of residency according to the Military Spouses Residency Relief Act MSRRA.

The Military Spouse Residency Relief Act Msrra H R Block

What Is The Military Spouses Residency Relief Act Law Offices Of Renee Lazar

Military Spouse Residency Relief Act Ppt Download

Https Www Columbus Af Mil Portals 39 Documents Other Change 20to 20msrra Pdf Ver 2019 01 31 154619 590

To The Spouse Who S Losing Their Sense Of Self Military Wife Life Military Spouse Military Lifestyle

Usmc Life Military Spouse Residency Relief Act Usmc Life

Navy Wife Navy Wife Navy Wife Life Military Wife Life

What Does The Update To The Military Spouse Residency Relief Act Mean Meditec

Moving Tips For Our Military Families The Military Spouses Residency Relief Act Msrra Movingal

Form Ar Ms Download Printable Pdf Or Fill Online Tax Exemption Certificate For Military Spouse Arkansas Templateroller

Military Spouses Residency Relief Act Wikipedia

Rmv Resources For Massachusetts Drivers In The Military Massachusetts Military Drivers

Understanding The Military Spouses Residency Relief Act And How It Applies To State Taxes Katehorrell

Https 341fss Com Docs Afrc Military Spouses Residency Relief Act Pdf

Https Www Malmstrom Af Mil Portals 43 Documents Afd 140729 019 Pdf Ver 2016 07 05 130855 637

Military Spouse Act Residency Relief Msrra Military Benefits